Financials for a WiFi Money Business (Ft. BowTiedF'er)

How to manage your money as a new business owner

Managing your money becomes a hassle as you grow and scale your business. For today’s post, I tagged in the Jungle’s #1 personal finance expert, BowTiedF’er. He covers everything you need to know: financial statements, bookkeeping, opening a business account, etc.

Follow F’er on Twitter and subscribe to the Fs I Give Substack to learn more.

Financials for an internet-based business by BowTiedF’er

You started your first WiFi income, congrats.

Things started slow but you followed Chads like BowTiedTetra and are starting to find some success.

Now you are making some money and looking to scale & grow. It becomes vital to track your finances and set your plans for the future.

Don’t worry, we have the basics laid out for you here. Understanding your finances will help you on the next steps to becoming a sovereign individual.

Bookkeeping for your Business

Accounting & bookkeeping can be intimidating when you start out, but bookkeeping for your small business doesn’t have to be overly complicated.

Business bookkeeping is nothing more than recording all the transactions of your business and tracking all you own & owe.

There are 5 basic overall accounts to know. These make up your 3 main financial statements.

Income or Revenue: Money earned through sales or services

Expenses: Money paid for goods and services

Assets: Anything of value owned by your business

Liability: Debt & Obligations owed by your business

Equity: Assets minus liabilities. The value remaining in the company that you own

These 5 accounts will help you with your budget planning, tax filing, and preparing for any reporting requirements.

In addition to understanding these financial statements, you should have a system that tracks receipts and expenses. This is to ensure you have adequate support to claim the costs as a legit business expense.

Also, you should have a regular cadence to monitor your cashflows to ensure your business is able to pay for any upcoming expenses. Lastly, on a monthly basis you probably want to monitor how your business is growing and profiting. That way you can look at month-over-month metrics.

Introduction to Financial Statements

A financial statement is made up of 3 major reports: Income Statement, Balance Sheet, and Cash Flow Statement. These 3 reports give an overview of the health of your business.

The financial statements will inform you if your business is profitable, cash flow positive, and solvent. These will all be important as you grow. Especially if you look for outside capital, like loans from a bank or equity investors. Additionally, financial statements may be required for tax filing purposes.

What is an Income Statement?

Your income statement is an overview of the performance of your business over a period of time. At a high level, the income statement shows your revenues and your expenses. Then it calculates your net income (profit).

Income statements are arguably the most used of the 3 statements as it allows for looking at period-over-period growth of revenues, expenses and profits. This allows an observer to see if the business is growing and if the costs of doing business is increasing disproportional to revenue.

Your revenues include:

Sales

Interest on any accounts/investments

Gains on any property or equipment sold

Your expenses include:

Cost of purchasing goods for sale

Marketing/advertising

Interest paid on any loans

Losses on any property or equipment sold

If your total revenue is more than your total expense you have a net profit. If your expenses are more than your revenue you have a net loss.

What is a Balance Sheet?

The balance sheet is a snapshot of the current asset & liabilities of your business. You can think of it as the current ‘net worth’ of the business and a count of what your business owns vs what your business owes.

Assets cover all items and securities your business owns:

Cash & investments

Accounts Receivable

Equipment, Land, Buildings

Insurance Paid

Liabilities are all the debts and money owed by your business:

Accounts payable

Salaries & expenses payable

Loans & taxes payable

Lease charges on equipment

Interest on any loans

When your assets are larger than your liabilities, your business has positive equity. Consequently, if your liabilities are more than your current assets, your business has negative equity. Companies with negative equity will face concerns over their solvency and likely the levels of debt they carry.

What Is a Cash Flow Statement?

For a business knowing your cash flow can be invaluable. A cash flow statement will allow you to monitor your cash balances.

Cash flow management is key when figuring out how much you can reinvest and how much you need to retain for expenses.

Cash flow may differ from profitability and a company can be profitable while being cash flow negative. Ultimately, a lack of cash flow leads to businesses going bankrupt as there isn’t enough cash to pay all the obligations.

If you choose accrual accounting for your income statement, you may want a separate profitability view on cash accounting basis. Additionally, items like debt repayment and equipment purchases (which are amortized on the income statement) are recognized at different times from when actually paid.

Do You Need All 3 Financial Statements?

No.

As a small business, you don’t NEED to produce all the financial statements every year. As a general rule you only need enough info to file for your taxes. This typically means just a simple income statement.

In the US, if you are under $5 million in revenue, you are allowed to have your income statement reflect either a cash or accrual accounting method, unless you carry inventory, then you need the accrual method.

Accrual accounting is when revenues and expenses get recorded when the transaction occurs – i.e. when the bill is sent. This means you need to have accounts payable and accounts receivable items on your balance sheet.

Cash accounting is when you record items when the money is received or paid, eliminating the need for a payables/receivables balancing item.

You will need to pick a method for your first tax year and stick with it going forward.

If you are an affiliate marketer, cash accounting is likely the option for you. First, you don’t have inventory. Second, pending affiliate commissions are NOT accounts receivable. (Tetra note: this applies the money accrued in the affiliate platform. If a company requires you to invoice them for payments, once you send the invoice it becomes part of your accounts receivable). Since you recognize your commissions when the cash comes in anyway, it aligns your timing. Lastly, cash accounting is basically just recording as money comes in/out which simplifies the process.

However, having all 3 statements can be a big help as it allows you to produce a budget and forecast for your business.

Benefits of Budgeting

Budgeting can be essential to your business. It is planning and forecasting the financials into the future. This serves a twofold purpose:

Planning into the future helps you avoid potential cash shortfalls

Forecasting gives you targets to monitor your progress against

Budgeting is basically filling out your financial statements into the future with estimated numbers. You can integrate your budget and planning into your financial statements.

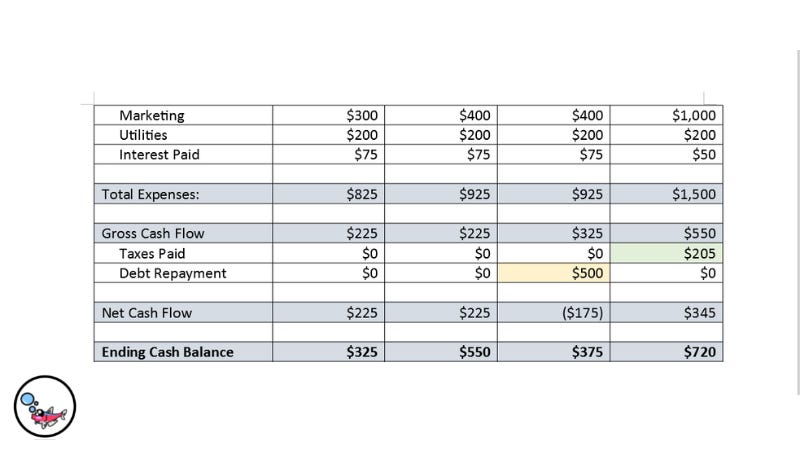

Below is a simple income statement and cash flow statement to highlight some of the differences between the two. You can use the samples as a starting point. However, they are not meant to be exhaustive and every business will have different line items. Consult a tax professional for your own particular situation.

A few notes on the above:

Depreciation/Amortization (peach) is an income statement item as there is no cash flow

For example- think about your car. The value depreciates over time, but it’s a ‘paper’ decrease and no cash is sent

Taxes are recognized each period on an income statement but only recognized when paid on a cash flow statement (green)

Note – many businesses will need to pay taxes quarterly, if you write the IRS a check, that is when you recognize it on your cash flow statement

Repaying debt in Q3 (yellow) is only shown on a cash flow statement as a cash outflow. The income statement only looks at the interest paid

Not shown above is if you have a lag between billing and cash collection. You may have the revenue line of your income statement differ from the revenue line on a cashflow statement.

You’ll note that Q3 & Q4 are estimates. You can incorporate your budget & plan right into the same sheet.

Estimated future financials are also known as a ‘pro forma’ statements

Separate Your Personal & Business Finances

In addition to having financial statements, you will want to have separate bank accounts and likely a separate business credit card. Depending on how your business is structured, this may be a requirement.

Keeping your personal finances and your business finances separate is an important step as you are getting started. Developing a system to segregate accounts and create a streamlined process to pay bills is a huge benefit for both your personal and business finances. Having a system that works for you is important.

Your business will have a lot of transactions, you don’t need to complicate it by having all your personal transactions also on the same account. When you are doing your year-end taxes, do you want to try to remember if that poorly described purchase on your statement was for business or (in my case) the 469th online order your wife made?

Even if you are an organizational master, going through each charge and trying to remember which was personal and which were business is a pain.

Opening a Business Banking Account

Opening a business banking account will be very similar to opening any personal bank account. If your business is an LLC, partnership, or corporation, you are likely required to have a separate bank account for business.

Even if not required, you probably want a separate account for your own sanity. Additionally, not comingling funds is the best practice for maintaining personal liability protection.

Since US Law considers companies as legal entities, like a person, you are able to open accounts in the name of your business. To open a business account, you likely will need the Tax ID/federal employer identification number (EIN) of the business and potentially the formation documents like articles of organization & certificate of formation.

Make sure to shop around when you are looking at business checking and savings accounts, there is a wide range of fees and features between banks. Also, some banks are less friendly to small, start-up businesses and may decline you if you haven’t started making significant sales.

You will want to take note of the fees and features. You’ll notice business accounts tend to have higher fees, but there are some basic business accounts that are largely fee free. When shopping around, compare:

Monthly Service Fees

And what the requirements are to waive/avoid these

Minimum balance requirements

Minimum amount to open an account

Number of free transactions & price per transaction after the limit

Cash bonuses when opening an account

Benefits of getting a company credit card with the same bank

Lastly, your business checking account will help as your business grows. Business accounts typically allow for easily adding users with specific abilities, issue corporate cards to employees with limits, and allow you to receive payments in the form of credit cards/ACH.

Expense Tracking/write offs

One of the big benefits of having your own business is the ability to write off expenses. However, you need to track the expenses and document them well.

[Note – I am not an accountant or tax advisor, these are general guidelines, but you need to confirm your own tax situation]

Some of the basic expenses that you can write off if you document well include:

Home office – If you work out of your home, you can deduct a portion of your home you use for business. Your home internet, personal cell phones, and cost of any business-related errands you run.

Since most of you are probably working on the WiFi money – work computer, programs, printer/paper, internet, etc are all expenses to offset some of your revenues

Vehicle – If you use your personal vehicle for business purpose you can write off mileage

Out-of-town Travel – if you spend a significant portion of your travel on business, you are able to write off much of the travel expenses

Meals – If you conduct business over a meal, you can deduct the meal cost

You should be able to see the value in having these expenses be deductible. But you need good documentation about ‘who, what, where, & why’ for each receipt to be able to show it was indeed a legitimate business expense and not just personal.

Wrap-up

Now you have the basic knowledge you need to go out and start tracking your business’ finances. By having adequate financial statements, planning & budgeting, and tracking expenses, you will set yourself up for success as you are starting out.

Good luck Anon.

Conclusion

Tetra here.

I hope this overview helped you out. I can personally verify that all of this information is extremely important for any new business owner to know.

If you’re an affiliate, then you’re VERY lucky because your financial statements are easy and simple to understand. E-com guys are a little bit different since you have inventory to worry about, so your statements will be a bit more complicated.

If you have any questions you can ask in the comments below. Make sure you follow and subscribe to BowTiedF’er to learn more about managing your personal finances.

Free articles on Second Income SEO are supported by:

►Surfer SEO - Generate an entire content strategy with a few clicks. This tool features a content editor that is equipped with Natural Language Processing technology that gives you the exact phrases you should use to help your article climb to page one in the SERPs and outrank your competition. If you’re not using this tool, you’re falling behind.

►Jasper - Use an AI assistant to write your content faster and easier. Jasper creates original content for meta descriptions, emails, subheadings, post headlines, website copy, and more. Automate your content creation and free up hours of your valuable time.

►Namecheap - Set up your first website with a few clicks. Follow an easy and intuitive process to set up a domain name and hosting. This is step one to earning WiFi money.