What Search Trends Reveal About the State of the Economy

It's rough out there

If you’ve been paying any attention at all over the past few years then you know that official data is bullshit (about everything). The government lies to us CONSTANTLY.

Luckily there is still a place we can go to get the real data: Google.

People are extremely honest when typing in search queries since it’s “anonymous” 😂.

Even if someone has no problem lying to your face, they’ll be brutally honest with Big Daddy Google. The famous minimalist screen and its empty search box is essentially the secular version of a Catholic confessional: it’s the one and only place where people reveal their true feelings.

Let’s see what the aggregated honesty of billions of people has to say about the state of the economy.

People are in debt and want to take on more

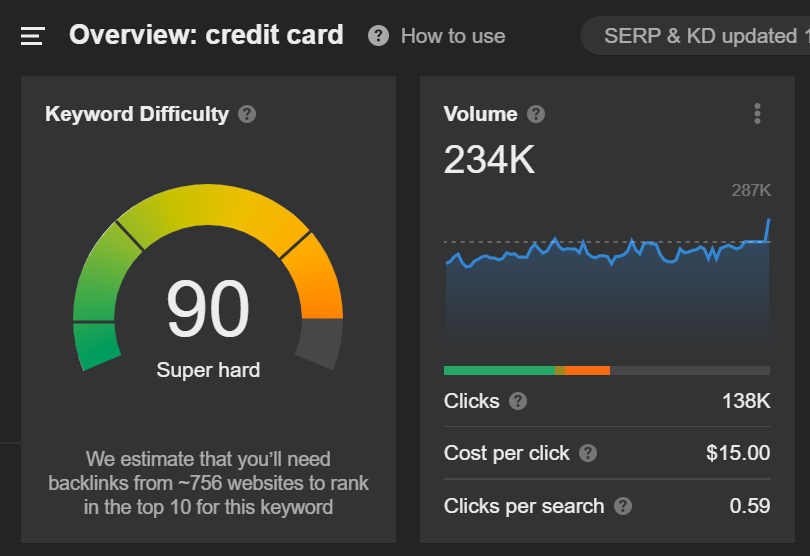

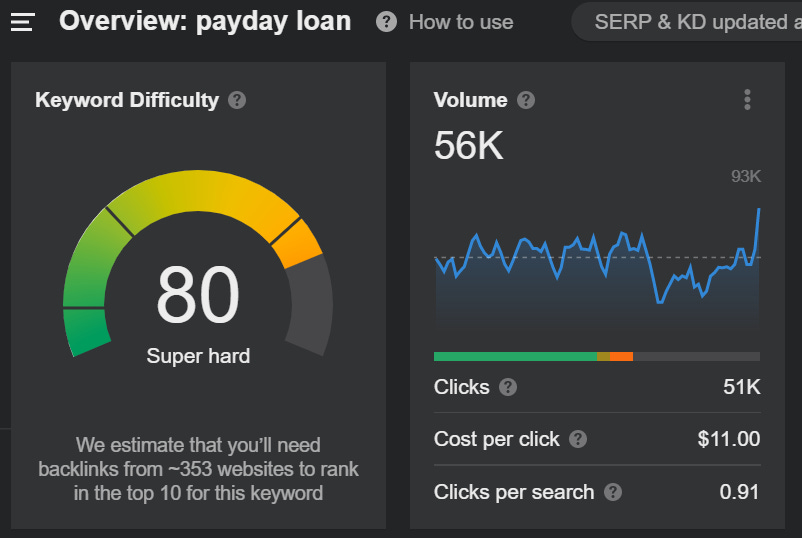

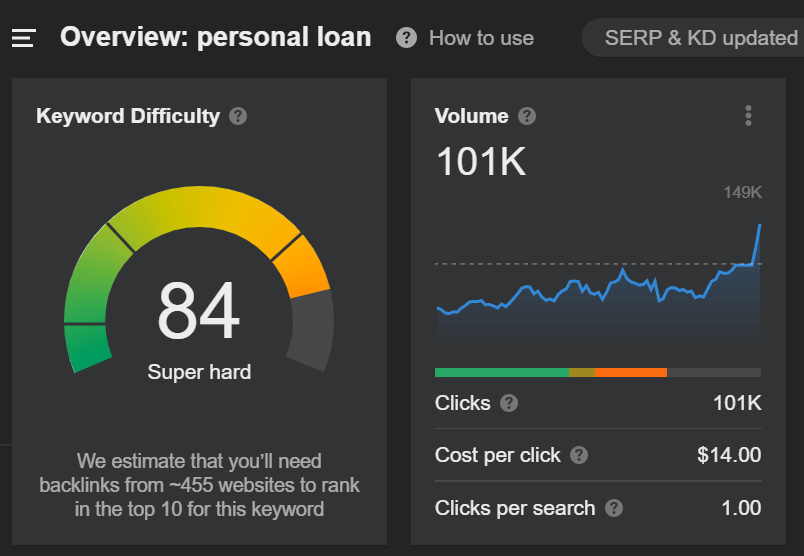

The search volume for “credit card”, “payday loan”, and “personal loan” are all spiking.

This indicates that people are at the end of their financial rope. They’ve tapped out their savings and are looking for alternative sources of capital: credit cards, payday loans, and personal loans.

It shouldn’t have too much of an impact on your business at this point in time. This data shows that people still want to live the pre-inflation lifestyle that they’re accustomed to. They’re willing to take on debt so they can keep on keeping up with the Joneses.

As inflation continues to increase it’s reasonable to expect that we’ll see some demand destruction in some of the dumber niches and products. You should focus your content on the “essential” products in your niche that people keep spending money on even when they “cut back”. You’ll have to figure this out for yourself since you know your niche better than I do, but I’m sure most have something “essential” that you can focus on.

Weird, quirky, trendy products that people don’t need for anything are going to see their demand drop to near zero.

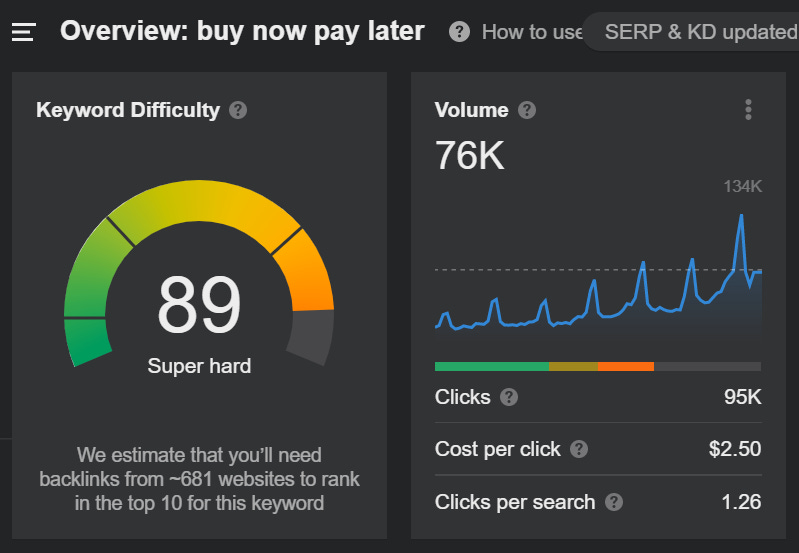

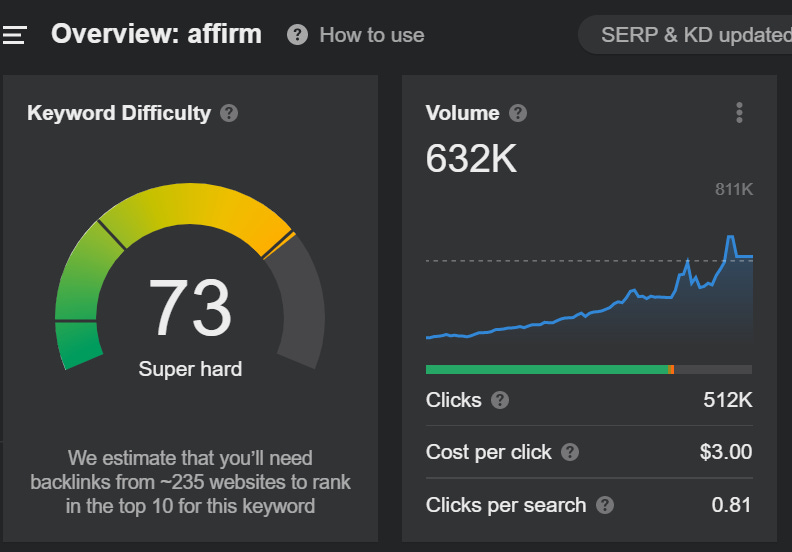

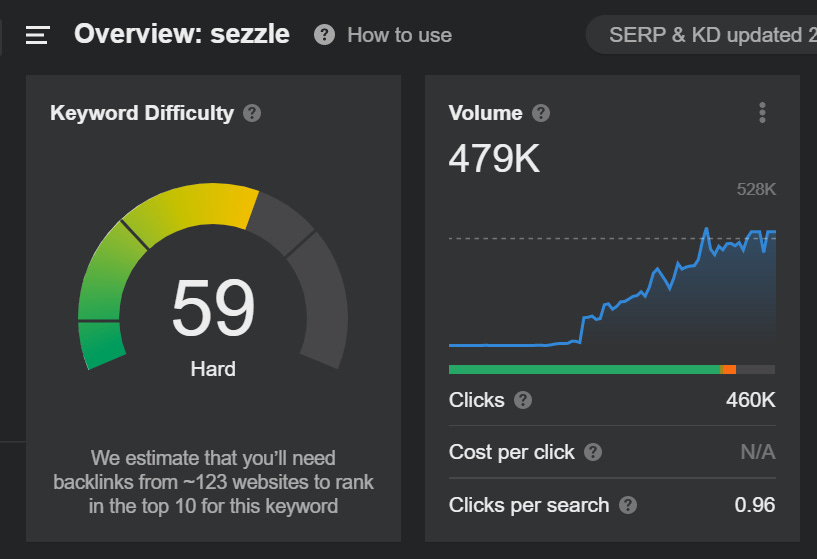

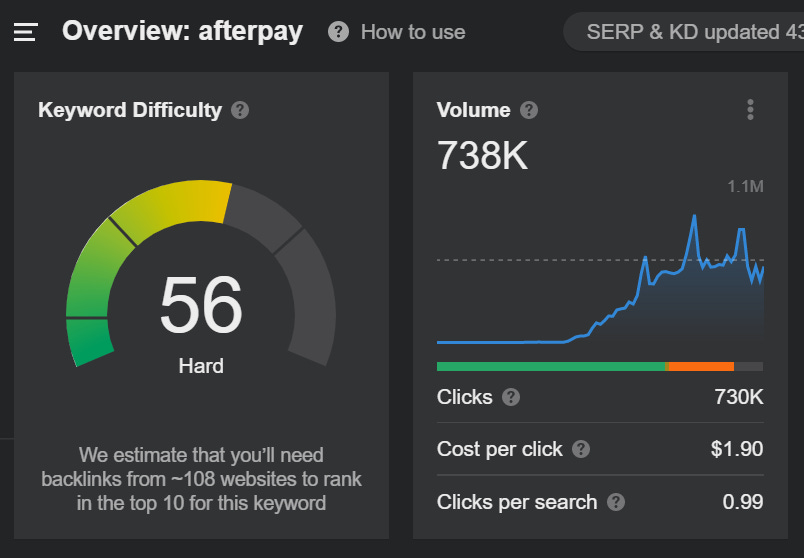

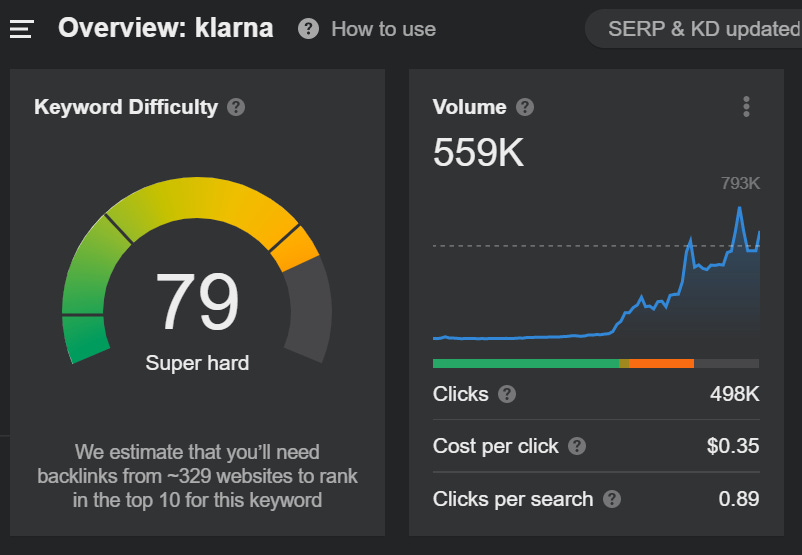

Buy now, pay later interest is increasing

The search volume for terms relating to buy now, pay later has been increasing over the past few years.

The spikes in the above charts represent holiday shopping periods. Each spike in search volume occurs around November/December and then it gradually declines. After each decline it stabilizes at a plateau that was higher than the previous one. This trend applies almost 100% across the board for each of the keywords.

Interest in using BNPL services is increasing. Just from looking at the charts it seems obvious why. Each year, a certain amount of people find that they’re struggling to afford Christmas presents. To help make it through the holiday shopping period they buy on credit.

The logic makes sense (in the short term).

“At least my kids will be happy this Christmas. I can always make up the payments later on. The small payments are affordable and I won’t even pay any interest if I pay on time”.

What happens after each spike (look at the screenshot for “buy now pay later”)? As I mentioned before, the number of queries declines and levels off after each holiday period, but the level it stabilizes at is much higher than the previous year.

A certain percentage of people who “temporarily” use BNPL services each Christmas become regular users. They become addicted to buying things without any upfront spending. The “small, affordable” payments take up an even bigger percentage of their income over time.

Many of these people are eventually going to default. There’s going to be a point in time where many of the lower-income BNPL users realize that the majority of their income is going to service past consumer debt and they’re going to stop making the payments.

That day is not today.

For now, the party goes on. If you have an affiliate site you should create best-of lists targeting BNPL keywords in your niche. If you have an e-commerce site you should offer a BNPL option at checkout and make sure it’s publicly visible on the product page.

BNPL is how people shop these days. It sucks, but if you refuse to participate you need to realize that you aren’t saving the world. People are going to open up a new tab and buy from a competitor who offers them the service they want.

Don’t be stupid.

People have jobs - for now

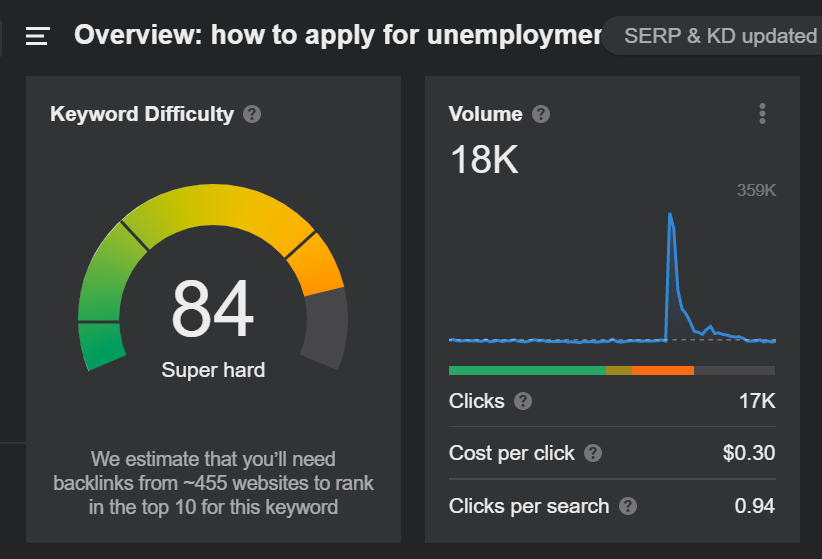

The search volume for “how to apply for unemployment” has declined to pre-COVID levels.

Since this query has a very specific search intent, I think it accurately reflects reality.

People have jobs. For now.

This is a good thing, but when viewed in light of some of the search trends listed above there’s some cause for concern.

If people are employed but still need to take out payday loans and use BNPL services when buying Domino’s Pizza (this is real) then it shows that they aren’t getting paid enough to afford the lifestyle they want.

We’re already starting to see a rise in labor union activity in places like Starbucks restaurants and Amazon warehouses. Once low-wage workers are able to effectively secure increased wages we’re going to see a wage-price spiral that’ll increase inflation dramatically (similar to what happened in the Weimar Republic).

There’s not much you can do with your online business with this data. You shouldn’t list prices on your affiliate site anyway (reduces incentive for people to click on your links), but this provides another reason: prices are going to keep increasing and it’ll be a pain in the ass to keep changing them.

If you’re selling a product then keep riding that BNPL wave as long as you can. Service businesses should target higher-income people, because eventually the low end is going to fall out.

That’s all in the medium-term future. For now, at least this one aspect of the economy is stable-ish.

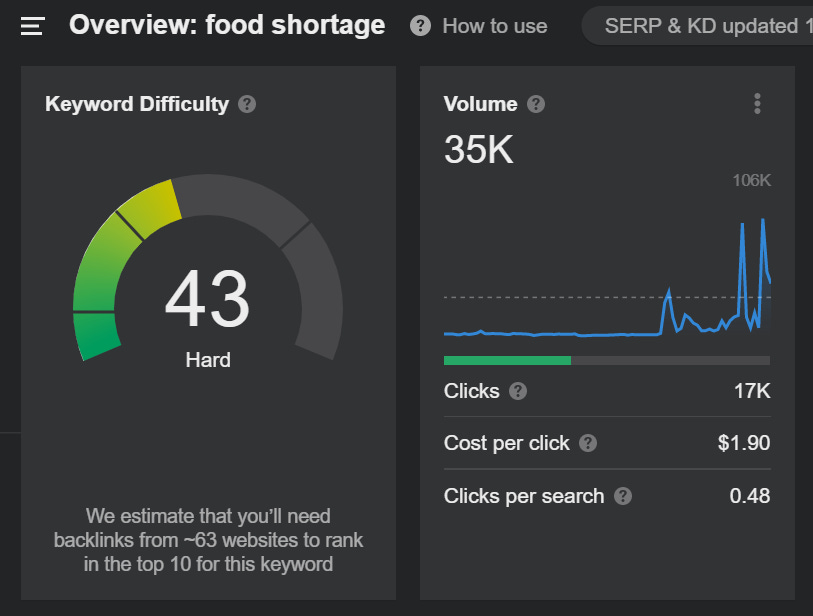

People are VERY concerned about food shortages

The upcoming famine that every government official has been warning us about is starting to freak people out.

It’s almost unbelievable that we’ve reached this point in the West, but here we are - by design.

The best thing you can do is follow Bull’s advice and start stocking up on meat and non-perishables because the shortage is coming.

Shortages also lead to price increases. This should motivate you to hustle harder on your business or start one if you haven’t already.

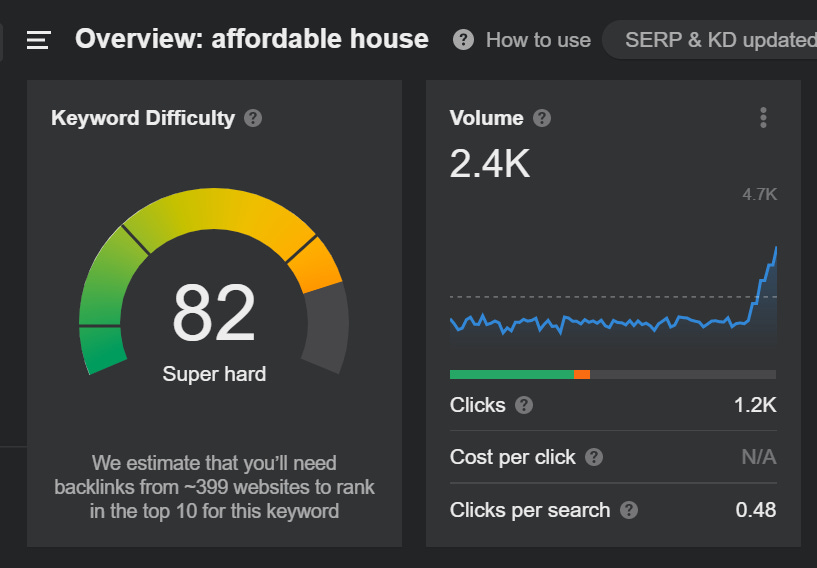

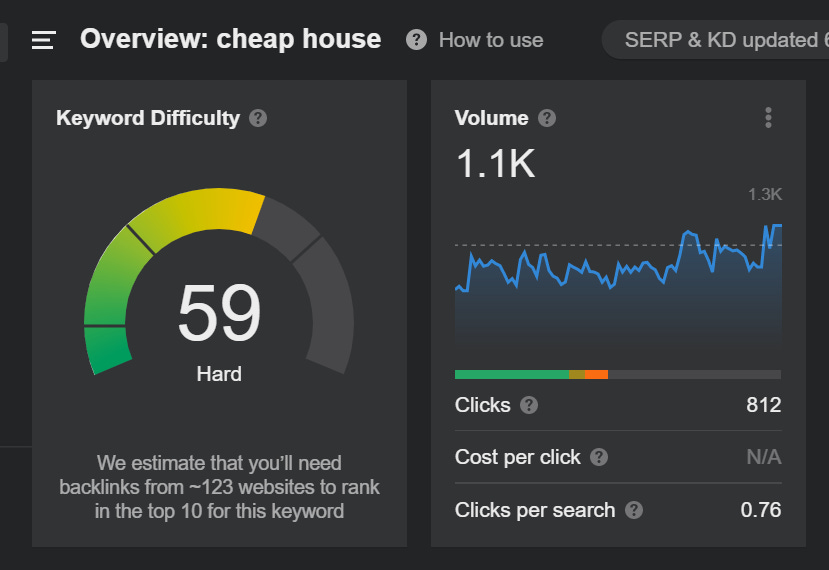

The real estate market is maxed out

Queries for “affordable house” are through the roof. Searches for “cheap house” are rising as well.

It’s obvious that people can’t afford houses. That much is clear from the data. But what does it mean for the real estate market?

It seems obvious that there’s going to be some type of real estate crash. I don’t think prices are going to decline as much as people are expecting, mostly because there are too many people who want it to happen (buyers).

Many millennials in their 30’s have been renting for their entire lives. Zoomers are broke as well. All of these people are foaming at the mouth for an opportunity to buy a house and live the American Dream. Will demand from these generations help support the market and make sure that it doesn’t crash as badly as ‘08? I think so. Either way, we’re about to find out.

Conclusion

The economy is very fragile and looks to be on the precipice of collapsing.

That won’t be a surprise to anyone reading this. Anyone who is aware of the Jungle knows what’s going on in the world.

As explained in The Sovereign Individual, the economy is transitioning from the Industrial Age into the Information Age. In the long run it’s all going to work out for highly motivated people who start their own businesses and take responsibility for their lives.

But in the short term there’s going to be a lot of pain. You should be aware of it - you don’t want to be naive and unprepared - but don’t obsess. Keep your head down and focus on your business and the things you can control. Avoid the traps that pop up along the way and keep grinding.

Turbo autists thrive in any economic environment.

Free articles on Second Income Strategies are supported by:

►Jasper AI (free trial) - Use an AI assistant to write your content faster and easier. Jasper creates original content for meta descriptions, emails, subheadings, post headlines, website copy, and more. Automate your content creation and free up hours of your valuable time.

►Murf AI (free trial) - Generate text-to-speech versions of your articles that you can embed on your site. Murf has human-sounding voices that are more authentic than any of the competing services I tried.

► Surfer SEO - Learn the exact phrases you should use in your articles to help them rank. After entering a keyword Surfer gives you an exact word count, image count, paragraph count, and specific keyphrases so you can boost your article to page 1 in Google.

This is a super interesting article. Thank you for your detailed and helpful research.

Great article as always, Tetra. WiFi money and self-sustainance is the way